Payment

Payment of wages and salaries

We have chosen to outsource legal employership to Maqqie. At the start of your employment, we will communicate with you when you will be paid. Maqqie uses a strict weekly, 4-weekly or monthly payment schedule. By default, they pay your hours every Friday after the week worked (with weekly payment). If you are paid per 4 weeks, they will pay for the hours of weeks 1 to 4 on Friday in week 5. If you pay monthly, you will be paid on Friday in the first full week of the new month.

Holiday Pay

Your holiday pay will be paid in the first full week of June.

Reservations and holidays

Upon termination of employment, your reservations and untaken vacation days will be paid out after 6 weeks.

Remuneration calendar

On the calendar below you will find an overview of our pay days. No rights can be derived from the above information and this calendar. We depend on the processing time of transactions at banks. Therefore, keep in mind that the salary is sometimes only credited to your account 1 or 2 days later and that payment transactions at banks are delayed around the holidays.

Payslip

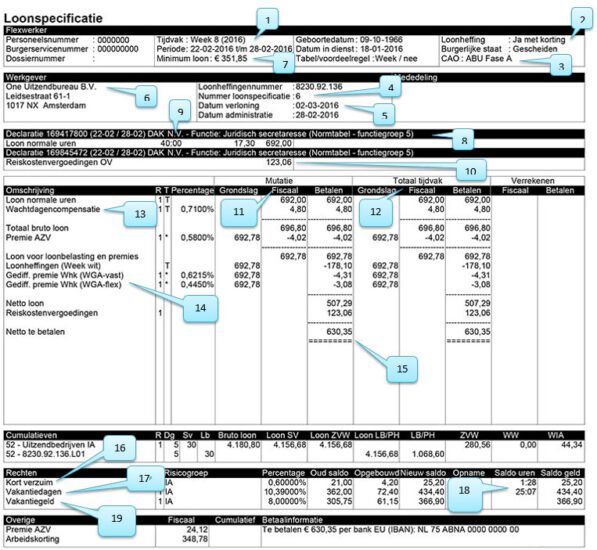

You will receive pay slips by email and can be downloaded if you have access to My Direct Jobs. The most important details of your pay slip are explained in more detail below. Due to the WAS, we state the net equivalent on the wage slip as of 1 January 2019, you can see this at the bottom under ‘explanation’.

- Pay period and period of the pay slip

- Whether or not payroll tax credit is applied

- Current phase according to the collective labor agreement for temporary workers

- Payslip number

- Date on which the remuneration and salary payment took place

- Legal employer

- Based on the applicable working hours at the hirer in combination with the WML

- Summary of hirer name, job description and job group

- The total of processed hours in the relevant period

- Extras in the form of (travel) reimbursements or deductions

- The mutation column indicates what has been paid/deducted to you on this salary specification

- The column ‘total period’ indicates the total amount paid/deducted to you in this wage period

- This compensation only occurs in phase A and concerns compensation for special leave and waiting days in case of illness. You cannot build up this compensation, but it is paid out over your gross salary as standard. Depending on your premium group, the percentage that you accrue is 0.71% (administrative) or 1.16 (other, premium group II).

- Premiums must be paid to the tax authorities for employee insurance schemes. As an employer, we pay these premiums to the tax authorities for you

- The amount that you will receive net, including fees

- You only accrue ‘Short absenteeism’ in phase A, not in phase B. You accrue 0.6% on your gross salary, including waiting days compensation. This percentage results in an amount, which is added to your existing balance. The final balance is translated into a number of hours (18).

- All temporary workers accrue 10.39% vacation days over their gross wages (including waiting day compensation in phase A). This percentage results in an amount, which is added to your existing balance. The final balance is translated into a number of hours (18).

- As mentioned above; your hour balance is stated here, which you can take for short absence or holidays

- You build up 8% holiday pay on your gross salary, which will be paid to you in June. If you leave employment early, all your accrued reservations will be paid out in one go.